Few outside the executive suite of utilities really appreciate how the regulatory regime affects executive behavior. As understanding behavior is key to selling, I am sharing my thoughts below, applicable mainly to North American utilities.

Problem Statement for Executives of Investor-Owned Utilities

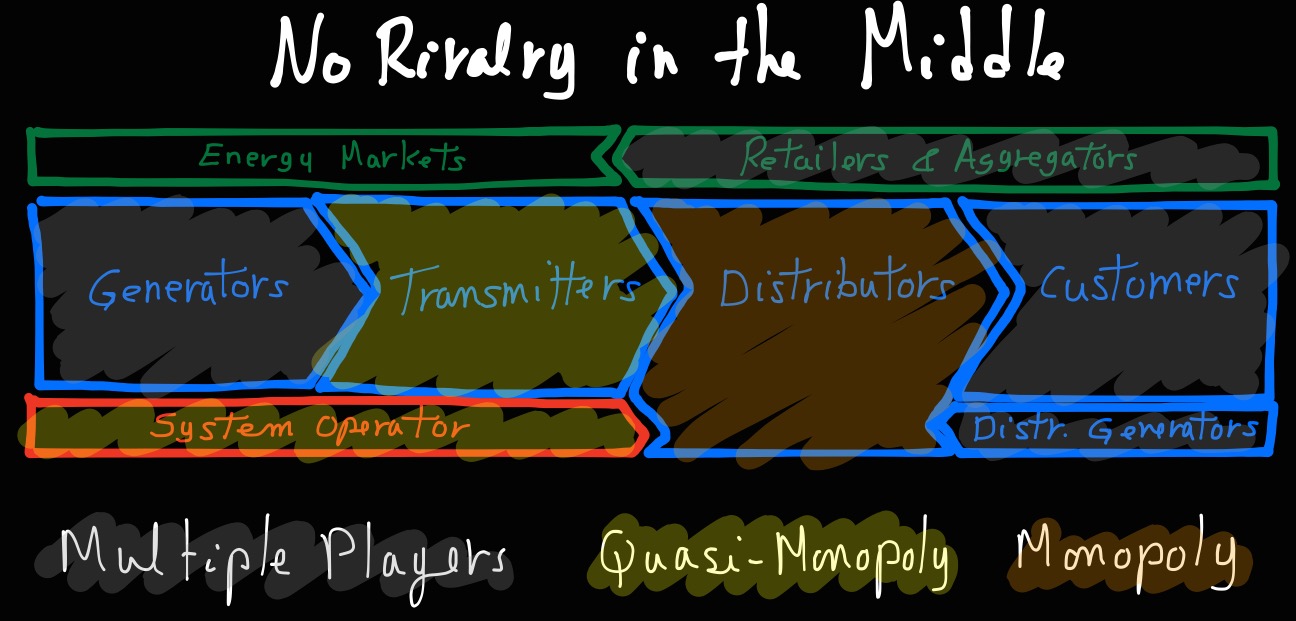

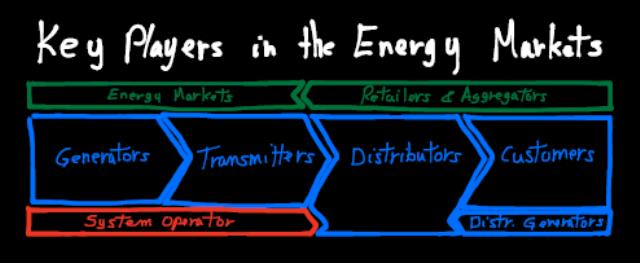

Given their monopoly over a defined territory, North American Investor-Owned Utilities (IOU) are subjected to price regulation by the state or the province, meaning that a regulator (such as a public service commission, a public utility commission or an energy board) sets the price they charge for the use of their infrastructure (poles, conductors, cables, transformers, switches, etc.).

Most North American IOUs are under rate-of-return regulation, or a variation of it. With rate-of-return regulation, regulator set the price so that utilities are compensated for their costs (operating costs, depreciation on assets, and taxes) and allowed a fair return on their investment. This is done by filing tariffs that are approved by the regulator following a rate hearing.

Utility executives are paid to maximize shareholder returns. Since utility shareholders are rewarded by a fair rate of return on a base of assets, executives create shareholder value by justifying more assets to the regulator while lowering the risk profile that shareholders perceive in future earnings. However, the regulator only allows new asset expenditures if they are prudent and if the society benefits. A capital expenditure is prudent if the costs are reasonable at the time they are incurred, and given the circumstances and what is known or knowable at this time. The society benefits if the expenditures minimize the required revenue paid by ratepayers, have a positive impact on the economy (such as improved reliability), improve customer service (such as fewer complaints), reduce societal risks (such as those caused by major weather events or those linked to information security), or achieve government policies and meet regulations (such as renewable generation targets). By constantly meeting regulatory concerns, utility executives ensure that the utility will be compensated through rates, with predictable earnings and minimizing the risk profiles that investors perceive. Conversely, when a utility fails to show that it is making prudent decisions or that the society benefits, then the regulator may disallow investments from the rate base. In such a case, shareholders bear the shortfall through reduced earnings and share value.

For utility executives, the fundamental objective is to select investment projects that minimize required revenue (a regulatory term defined as operating expenses + depreciation + taxes + return on assets) while being prudent and maximizing societal benefits (to ensure approval). These projects increase the regulated base of assets while minimizing the shareholder risk profiles. This is why utility executives are generally willing to trade lower operating expenses (which is the only other controllable element in the definition of required revenue) for higher capital expenditures. It is also why they are seeking ways to lower operating expenses through subcontracting or outsourcing, as it frees revenue to justify additional capital expenditures. This is often expressed as a rule of thumb, such as “we are OK with $10 of capital to save $1 of operating expenses”, although regulatory approval is always required.

Expressions such as “equipment failures hurt the bottom line” make little sense for a utility executive: if an old equipment that failed is replaced by a new one, that’s actually good, as the old one is written off (the loss being recovered from the ratepayers) and a new asset is added to the base (for which shareholders will get a return). Similarly, the expression “reducing operating expenses improves your bottom line” is not absolutely true – such reduction eventually accrues to ratepayers, not shareholders, but often just to offset other increases. However, it can be true in a sense if the reduced operating expenses are the result of capital expenditures that increase the asset base and, hence, the return paid to shareholders. Hypothetically, utility executives should want to replace all (non-executive) workers (i.e., operating expenses) by robots (i.e., capital assets).

This leads to a number of factors that utility executives ponder when deciding on new investment projects. They will be inclined to support an investment project before their regulator if it results in a combination of the following factors, arguably ordered from the strongest down:

- Meeting governmental obligations:

- Meeting statutory obligations, such as workers’ health and safety regulations and CIP V5 cybersecurity standards.

- Meeting policy obligations, such as integrating renewable sources in the distribution network, energy conservation programs, removal of PCB or oil filled equipment, and reduction of greenhouse gas emissions.

- Prudency, which determines if the costs are reasonable with what is known at the time of filing.

- Lower rate impact:

- Lower operating expenses, such as avoiding overtime truck rolls.

- Lower energy costs for rate payers, such as if technical losses are diminished.

- Stretched service life or reduced maintenance costs of existing assets, such as by limiting stress on station transformers installed 50 years ago and approaching end-of-life.

- Lowering carbon taxes.

- Reduced societal risks:

- Greater resiliency during major events, such as looping distribution feeders and underground construction.

- Better public safety, such as avoiding forest fire.

- Positive impact on the economy:

- Reducing sustained or momentary outage costs.

- Three-phasing of rural lines to better serve C&I customers.

- Improved quality of service:

- Improved customer service metrics, such as fewer customer complaints from flickers.

- Fairness among customers, such as improving reliability experienced by customers in rural areas to approach that of urban areas.

Each utility operates in its own regulatory and societal environment. Therefore, the relative importance of these factors varies between utilities. In particular, some price-cap regulation is starting to appear in North America. With price-cap regulation, prices are set from a starting point and then adjusted according to an economic price index (such as CPI) minus some expected productivity improvement and plus or minus incentives. However, few states and provinces have moved to price-cap regulation for electric utilities. Also, given that the starting point of price-cap is rate-of-return, and given that unforeseen events may cause utilities to petition regulators for additional capital spending, the difference in executive behavior between the 2 regimes may not be as large as one might think. Still, with utilities under price-cap regulation, it is better to talk about total cost of ownership than about capital spending. Some utilities also have quality of service incentives that increase the importance of reliability indices.

Problem Statement for Executives of Customer-Owned Utilities

Customer-Owned Utilities (COU), essentially cooperatives and municipal utilities, are often regulated by their local government (such as a city council), just like other city services like water and waste disposal. They typically have a shorter feedback loop with customers than IOUs. Contrary to executives of investor-owned utilities, executives of customer-owned utilities do not have an incentive to maximize their base of assets, so tradeoffs may favor more operating expenses, especially so since they are seen as good employers in their communities. Investment decisions will weigh more on societal benefits and risks, with emphasis on customer service and quality of service. Therefore, it is important to adjust the language, as insisting on capital investments only does not make sense for customer-owned utilities.

Large Canadian provincial utilities and municipal utilities across North America are publicly owned, like traditional COUs, but often pay dividends to their owners. Their behavior is normally somewhere between those the IOU and COU extremes, especially if most of the rate increases can be shifted to generators.