J’ai récemment lu How Big Things Get Done de Prof. Bent Flyvbjerg et Dan Gardner. C’est un livre fascinant, à la fois érudit et accessible, qui plonge dans le monde des grands projets d’infrastructure. Dans cet ouvrage, les auteurs analysent une base de données comprenant plus de 16?000 projets, et démontrent, à l’aide de statistiques, que la plupart d’entre eux dépassent leur budget et leur échéancier, parfois de manière spectaculaire.

(English Version : https://www.linkedin.com/pulse/comment-les-grandes-choses-se-r%25C3%25A9alisent-ou-%25C3%25A9chouent-benoit-marcoux-lsibe/)

Je n’ai jamais dirigé de mégaprojet de l’ampleur de ceux décrits dans le livre. Le plus grand projet dont j’ai eu la responsabilité atteignait environ cent millions de dollars. C’est déjà imposant pour une équipe, mais bien loin des dizaines de milliards des projets de barrages, de centrales nucléaires ou des Jeux olympiques étudiés par Flyvbjerg. Cela ne m’a pas empêché d’être curieux de voir ce que je pourrais en tirer, et j’y ai trouvé des enseignements applicables, même à plus petite échelle.

Le constat n’est pas que tout est condamné à l’échec, mais que certains types de projets réussissent beaucoup mieux que d’autres. Les messages clés sont clairs : la modularité est puissante et il faut penser lentement, agir rapidement. Lorsqu’un projet peut être découpé en modules répétitifs et standardisés, comme c’est le cas pour le solaire ou les batteries, les risques chutent. À l’inverse, les projets uniques, massifs et fortement innovants, comme les grands barrages hydroélectriques ou le nucléaire, accumulent les dangers de dépassements. Flyvbjerg note qu’un pourcentage d’entre eux sont des projets à «?fat tail?», dont la distribution des risques est asymétrique : la partie droite de la courbe est plus lourde que dans une distribution normale, ce qui accroît fortement la probabilité de dépassements extrêmes de coûts ou de délais.

Intrigué, j’ai voulu voir où se situe Hydro Québec dans ce portrait. Mon intuition était que l’entreprise faisait mieux que la moyenne mondiale, car elle a construit en série des barrages pendant des décennies, accumulant une expertise institutionnelle rare. L’analyse des nouvelles centrales mises en services dans les 25 dernières années confirme cette intuition : alors que la moyenne mondiale des dépassements pour les barrages est d’environ +75 % dans la base de données de Flyvbjerg, le bilan d’Hydro-Québec apparaît beaucoup plus modéré.

La centrale Sainte-Marguerite-3, mise en service en 2003, avec ses innovations risquées (grands groupes turboalternateurs assemblés sur place, construction souterraine), a connu de graves difficultés techniques et fût l’un des projets le plus ardus des dernières décennies. Les sources publiques indiquent un coût de construction d’environ 2,5 milliards de dollars, pas très au-dessus de l’estimation initiale, car plusieurs déficiences étaient sous garantie, mais la mise en service a été retardée de 2 ans par rapport à l’échéancier et les problèmes prolongés ont fait en sorte que la pleine capacité n’a été atteinte qu’en 2007, suivie d’un nouveau bris en 2009. Ces retards ont créé un coût d’opportunité, puisque l’électricité attendue n’a pas pu être livrée. Selon les hypothèses sur la production perdue et les prix de l’électricité, ce coût d’opportunité pourrait atteindre quelques centaines de millions de dollars, un dépassement qui n’apparaît pas dans les comptes de construction, mais qui reste limité à environ 20 ou 25 % du coût de construction, largement moins que la moyenne des dépassements calculée par Flyvbjerg.

Pour des centrales comme Eastmain-1A et Sarcelle (mises en service entre 2011 et 2013) et Romaine-1 à -3 (mises en service entre 2014 et 2017), l’information sur les coûts est moins précise, mais aucun écart majeur n’a été rapporté.

Le projet Romaine-4, mis en service en 2022, en retard d’un an, a été plus difficile, avec des difficultés techniques (comme la friabilité du roc) et la pandémie de COVID-19. Le coût total de la réalisation du complexe de la Romaine s’est élevé à 7,4 milliards de dollars, soit seulement 14 % de plus que l’estimation initiale. Cependant, Romaine-4 a été la principale cause des dépassements de budget.

Globalement, la performance d’Hydro-Québec est bien meilleure que la moyenne mondiale pour la catégorie hydroélectrique de Flyvbjerg, même en incluant les projets difficiles qu’ont été Sainte-Marguerite-3 et La Romaine-4.

Cette particularité québécoise est probablement due à ce qu’on appelle l’«?effet de série?» : sept nouvelles centrales ont été mises en service au cours des 25 dernières années. Quand les ingénieurs passent d’un chantier à l’autre, la mémoire organisationnelle compense une partie du risque. Cet effet de série s’étend aussi à la chaîne d’approvisionnement, solide au Québec, avec des turbiniers (Voith Hydro, ANDRITZ Hydro, GE Vernova, Litostroj Hydro) et de grands entrepreneurs (comme Pomerleau), appuyés par un écosystème complet de manufacturiers internationaux (comme Hitachi Energy et Schneider Electric) et de nombreuses PME locales. Cet écosystème encore trop méconnu du grand public est l’un des joyaux industriels du Québec et un facteur clé du succès d’Hydro-Québec. Il faut toutefois rappeler que le risque de dépassement demeure réel, et que les projets d’Hydro-Québec ne sont pas à l’abri. Ce risque pourrait même croître avec le ralentissement probable du rythme de construction, même si une partie de l’expertise est appelée à perdurer grâce aux travaux de réfection déjà en cours sur les centrales existantes.

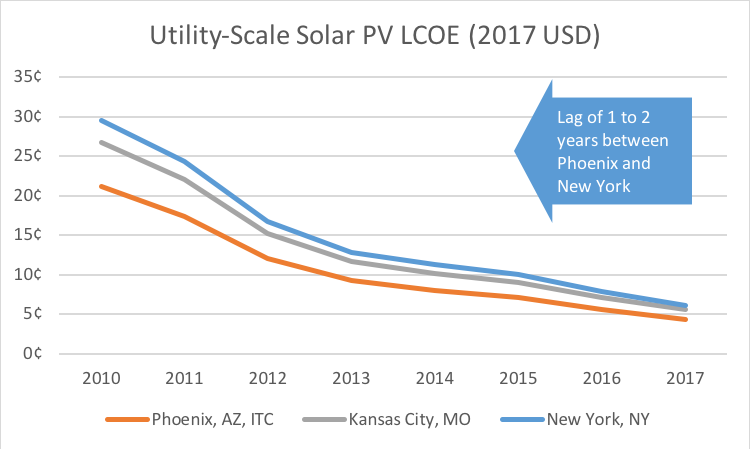

Le contraste est quand même frappant avec les projets solaires, qui affichent dans la base de Flyvbjerg des dépassements pratiquement nuls. Ces technologies, qui sont intrinsèquement modulaires, faciles à mettre en œuvre et prévisibles en termes de coûts, doivent être intégrées à l’arsenal québécois. Développer une expertise locale dans ces filières n’est pas un luxe : c’est une nécessité si l’on veut maîtriser les risques tout en répondant aux besoins d’électrification.

How Big Things Get Done se lit à la fois comme un avertissement et comme un guide pratique. Le Québec a bâti son histoire énergétique sur des mégaprojets hydroélectriques qui l’ont distingué dans les statistiques mondiales. Pour l’avenir, il faudra sans doute conjuguer cette tradition avec l’esprit de modularité du solaire et du stockage. Penser lentement, agir rapidement — et choisir les bons outils pour les grandes choses à venir.