I will be making a conference to investors later this year and I will also be training some people internally at my employer. The topics will touch on the electricity industry structure and I am preparing some material for it.

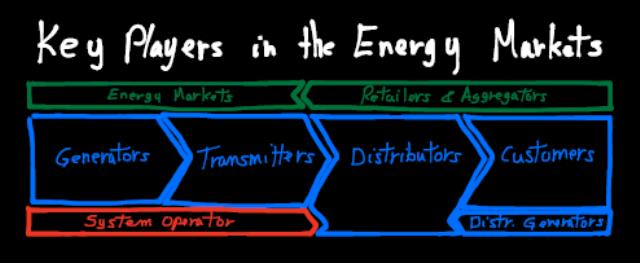

The industry can be quite complex in some jurisdictions. I boiled the complexity down to just this:

Traditional large-scale generator own and maintain coal, natural gas, nuclear, hydro, wind and solar plants connected to transmission lines. Those are large plants – typically hundreds of megawatts.

Transmitters own and maintain transmission lines – the large steel towers seen going from large generators to cities. Those typically run at 120,000 volts and more, up to over 1,000,000 volts in some cases.

Distributors own and maintain the local infrastructure of poles and conduits going to customer sites. Those typically run at 1,200 to 70,000 volts, usually stepped down to 600 volts. 480 volts, 240 volts or 120 volts for connection to customers.

Most customers are connected to distributors, although some large industrial facilities (such as aluminum smelters) are directly connected to transmission lines.

While customers are connected to distributors, they purchase electricity from an independent retailer or from the retail arm of a distributor.

With customer installing distributed generation on their premises, they sell back power to the market, often through aggregators.

Retailers buy electricity from generators in an energy market – like a stock exchange, but for electricity.

By definition, the energy produced at any instant must be equal to the energy taken by customers, accounting for a small percentage of losses in transmission and distribution. (We are starting to see large-scale storage operators, which may act as both consumer and generator, depending they are charging or releasing electricity in the network.) This critical balance is maintained by the system operator that direct generators to produce more ore less to match load; in some case, the system operator will also direct distributors to shed load (customers) if generation or transmission is insufficient to meet the demand.

The next post will deal with energy and money flows in the market.