(LinkedIn version: https://www.linkedin.com/pulse/volatility-point-why-renewables-seen-haven-stability-benoit-marcoux-kot4e/)

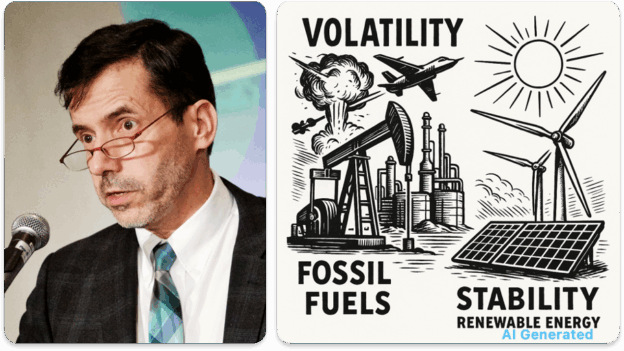

The recent variability in oil prices following the June 2025 bombing of Iran’s nuclear facilities is a grim reminder of how deeply the global economy remains entangled in volatile fossil fuel markets. As energy markets react with spasms to each geopolitical tremor, a clearer truth emerges: volatility is not a bug of petroleum-based systems; it is a feature.

Volatility as a Tool of Control

Oil markets have always been subject to booms and busts, and this pattern is not new. Since at least the 1970s, volatility has been used—sometimes strategically—to shape global politics, redirect capital, and influence public policy. Yet volatility is not wielded recklessly. Low-cost producers, such as Saudi Arabia, often manage supply with discretion and patience. Their goal is not constant disruption, but long-term advantage.

When global oil demand will begin to decline, however, the strategic utility of volatility may grow. By design or consequence, price instability can serve multiple purposes:

- High prices most of the time sustain rents for low-cost producers.

- Occasional price collapses shake out higher-cost competitors, like US shale or Canadian oil sands.

- Persistent uncertainty undermines capital flows into electrification and renewables, slowing the transition.

In this sense, volatility perpetuates the status quo. It discourages investment in clean energy and deters policy ambition, all while preserving dominance for the lowest-cost fossil producers.

This instability is not only structural but also exploitable. Whether through war, embargo, sabotage, or tariffs, fossil energy flows are vulnerable by design. Those who control them understand the strategic value of disruption. Geopolitical shocks, such as the Iran strike or Russia’s war on Ukraine, ripple through global markets not only because of supply interruptions but because energy dependence turns every international conflict into a domestic economic crisis.

Importantly, volatility is not entirely manufactured. External shocks—wars, cyberattacks, natural disasters, or supply chain failures—will always affect global energy systems. But the fossil-based system amplifies those shocks and leaves jurisdictions more exposed. Renewables, by contrast, offer a structural buffer against both strategic manipulation and unplanned disruptions.

Adding to this, declining investment in upstream fossil fuel infrastructure, as now seen, introduces a new risk. If the energy transition slows or stalls while fossil demand remains high, a supply squeeze could emerge later this decade. This mismatch between falling investment and persistent demand could cause significant price spikes, even in the absence of a geopolitical crisis.

The Myth of “Reliable Fossil Fuels”

For over a century, fossil fuels have been sold to the public, and to policymakers, as reliable. But reliability is not the same as stability. A barrel of oil is subject to both physical and political constraints. Physically, production depends on finite reserves, extraction delays, infrastructure bottlenecks, and extreme weather. Additionally, not all oils are the same—refineries are designed for specific blends, making substitution during supply shocks more complex and costly. Politically, prices are shaped by human decision-making in opaque and often undemocratic regimes. These decisions can include production quotas set by OPEC, export bans, political brinkmanship, or strategic stockpile releases, all of which inject uncertainty into global markets. What looks like price efficiency is in fact a rollercoaster powered by cartel logic, speculative finance, and the whims of petro-state politics.

Electricity markets built around fossil generation inherit this same vulnerability. Gas-fired peaker plants respond quickly when called upon, but are subject to price variability in global gas markets. Even places with abundant oil or gas resources are not immune to price swings, since prices are set on international markets. While these regions may not face availability issues, their energy costs will still fluctuate with global conditions such as weather, war, and world trade. Coal, in contrast, may be sourced locally in many regions and can appear more stable in price. This local availability has sometimes made coal the preferred option where availability and price volatility of natural gas are politically or economically difficult to absorb, despite its environmental impact.

Renewables: From Intermittent to Predictable

Ironically, the main criticism of renewable energy—its variability—may soon become its most reassuring trait. The sun rises and sets with precision. Winds may vary, but patterns can be forecast with increasing accuracy. Solar irradiance and wind speed are not subject to military coups, trade embargoes, or speculative squeezes. Their variability is meteorological, not geopolitical. While wind and solar output can vary significantly over the course of a day, their seasonal and annual yields are highly predictable. The temporal pattern of these resources, which combines short-term fluctuations with long-term stability, makes them far more suitable for use in modern grid planning and financial forecasting than fossil fuels. The latter’s future prices and availability are subject to complex political and market factors that are difficult to predict. Areas with abundant hydro, like Québec, where I live, with Hydro Québec‘s dams, are especially fortunate, as hydroelectricity can absorb the daily and seasonal intermittency of wind and solar, strengthening overall system reliability.

Even more importantly, the sun and the wind are not traded on volatile global commodity markets. They are free, local, and immune to diplomatic tension. And their infrastructure can be built closer to where electricity is consumed, improving resilience, creating local jobs, and reducing exposure to distant supply shocks. Unlike oil and gas, renewable infrastructure can be developed in any jurisdiction, regardless of natural fossil resource endowment. This opens the door to regional strategies for economic development. Any country or province can pursue industrial policies to manufacture green technologies, such as solar panels, batteries, heat pumps, or wind turbine components. The energy transition becomes not only a climate imperative, but a jobs and competitiveness strategy.

Moreover, with declining battery costs, demand-side flexibility tools (such as smart EV charging, vehicle-to-grid (V2G), and dynamic pricing) and integration with flexible hydro generation, the challenge of integrating variable resources becomes increasingly manageable. These tools allow renewables to align with demand in ways fossil systems cannot.

Already, jurisdictions like South Australia and California have experienced periods of 100% wind and solar generation without reliability issues. In parallel, local storage, rooftop solar, and microgrids offer added layers of stability. They also reframe energy strategy through a risk management lens. With predictable long-term output, local deployment, and immunity to global commodity price swings, renewables act as stabilizing assets in an otherwise volatile energy landscape. They turn consumers into participants in a more adaptive, lower-risk system.

A New Definition of Energy Security

True energy security will not come from doubling down on pipelines or LNG import terminals. It will come from structurally reducing exposure to volatile fossil markets. That means overbuilding renewables, reinforcing electricity interconnections, and deploying energy storage and flexible loads to absorb variability. Yes, it requires upfront investment, but the payoff is a future where energy prices are not dictated by distant conflicts or rogue politicians.

As the costs of renewables continue to fall and geopolitical disruptions continue to rise, we are likely to witness a narrative reversal: renewables will no longer be dismissed as unreliable. Instead, they will be embraced as islands of stability in an increasingly chaotic world. They are built on resources that are local, predictable, and free from the turbulence of global power politics. Investors, policymakers, and citizens alike will come to see that the real risk is not in intermittent solar or wind—it is in clinging to the illusion of fossil reliability.