There’s an increasing level of interest in the industry to use the energy stored in EVs to manage demand and supply peaks, drawing on the EV batteries to support the grid, referred to as Vehicle-to-Grid (V2G). In concept, V2G is similar to using stationary batteries in people’s home as a distributed energy resource, a concept that has been growing in interest, with Green Mountain Power being the first utility with tariffed home energy storage programs[i] for customers. However, in some ways, V2G has more potential than stationary batteries, but also more challenges.

With V2G, EVs may be used as distributed grid-resource batteries. Then, a plugged-in EV with a sufficiently charged battery and a bidirectional charger may get a signal to discharge the battery when called upon to support the grid (demand response) or to optimize a customer’s electricity rates (tariff optimization).

When associated with a home energy management system, V2G may be used as a standby power source during outages, a feature referred to as Vehicle-to-Home (V2H). V2G is also related to Vehicle-to-Load (V2L), where the vehicle acts as a portable generator. Collectively, these functions are often referred to as V2X, although they all have their own characteristics, as described below.

The Case for Residential Light-Duty EV V2G

The case for residential light-duty EVs is compelling because the batteries in modern light-duty EVs are large in comparison to their daily use, being sized for intercity travel (like going to the cottage on the weekend, or an occasional trip to visit friends and family), leaving significant excess capacity for use during peaks. For example, modern long-range EVs have batteries of 60 kWh to 100 kWh, for a range of 400 km (250 mi.) to 600 km (400 mi.) — significantly more than what is required for daily commute by most drivers. This means that light-duty passenger vehicles can leave home after the morning peak with less than a full battery and still come back at the end of the day with a high remaining state of charge for use during the evening peak.

In terms of capacity, residential V2G compares favorably to home energy storage systems and commercial EV fleets. Indeed, home energy storage systems (like the Tesla Wall, with 13,5 kWh of usable energy[ii]) have far less capacity than modern EVs. As for medium or heavy-duty fleet EVs, they have a high duty cycle, with their batteries size usually optimized for their daily routes, leaving little excess capacity for use by a V2G system during peaks, with some exceptions, such as school buses[iii].

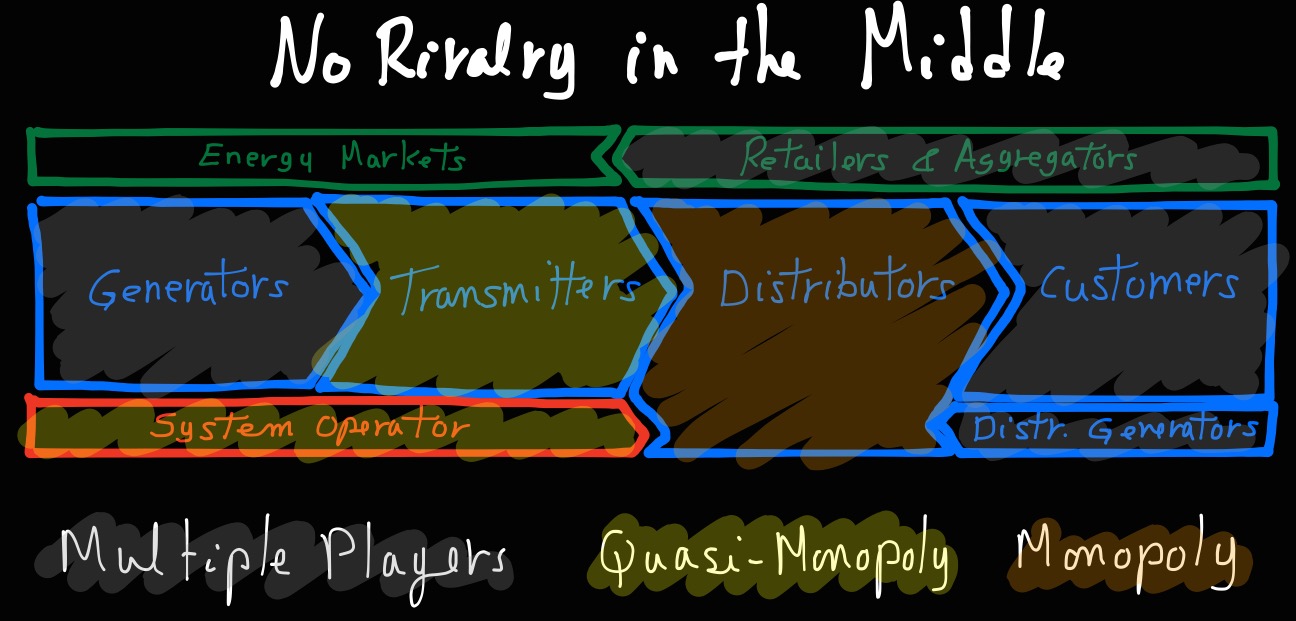

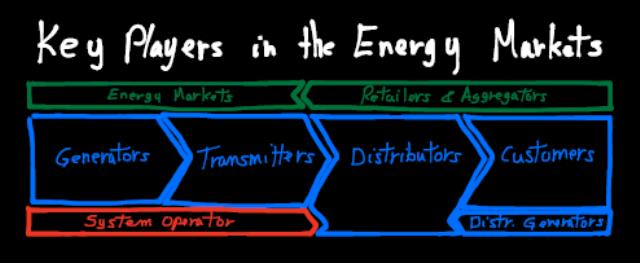

Extracting value from residential light-duty EV V2G can be achieved at the consumer level or at the utility level, but depending on the local regulatory framework and the energy, capacity or ancillary market structure:

- Consumers may use V2G to leverage utility dynamic rates and net metering tariffs (or other bidirectional tariffs), charging the EV when rates are low and feeding back to the grid when rates are high. Typically, the consumer would own the V2G system. The consumer (or a third-party service company hired by the consumer) controls when the EV is charged and when it is discharged, following rules to ensure that the consumer driving needs and cost objectives are met.

- A customer’s utility may also control the V2G system to optimize grid supply, charging the EV when wholesale prices are low or when generating capacity is aplenty, and feeding back to the grid when market prices are high or capacity constrained, therefore benefitting all ratepayers. As enticement for the consumers to participate, the utility would need to subsidize the V2G system or to have a recurring payment to the consumer.

- In some jurisdictions, third-party aggregators may act as an intermediary between consumers and the energy, capacity or ancillary markets. Consumers are compensated by a subsidy, a recurring payment, or a guaranteed rate outcome.

However, the potential of V2G also depends on automakers. Automakers are announcing V2X features, such as Volkswagen[iv] and Hyundai[v]. Aware of the economic potential of V2G and their gatekeeper position, automakers will want to extract some value from it, especially as V2X would increase the number of charging and discharging cycles of the battery, possibly affecting its service life, the warranty costs and civil liability. Automakers could extract value from V2G a few ways, including with an ordering-time option, a one-time software option, or even as an annual or monthly software fee to enable to a V2G function.[vi] Here again, cooperation among automakers will be important as the V2G interfaces to the grid are being defined; there are some signs that such cooperation is starting to take place, as shown by the common position of the German Vehicle Association, the VDA.[vii]

V2G vs. V2H vs. V2L

V2G should be distinguished from Vehicle-to-Home (V2H) and Vehicle-to-Load (V2L) use cases, as V2H and V2L do not feedback power to the electrical grid to relieve grid constraints or optimize customer rates.

- V2H is analogous to using the EV battery as a standby generator for use during a power outage. A V2G vehicle, when coupled with a home energy management system, may also offer V2H.

- V2L is like using a portable generator to power tools at a construction site or a home refrigerator during a power outage. V2G vehicles may or may not have plugs for V2L, although this is an increasingly common EV feature.

V2G and V2H or V2L have different power electronics and standards to meet. V2H and V2L are easier to implement as they do not have to meet grid connection standards, while V2G systems must meet DER interconnection standards. An example is Rule 21 in California which makes compliance with IEEE 2030.5 and SunSpec Common Smart Inverter Profile (CSIP) standard mandatory distributed energy resources.[viii] On the other hand, a V2H or V2L vehicle (or its supply equipment) needs to have a grid-forming inverter, while a V2G inverter acts as a grid-following power source.[ix] [x]

On-Board V2G (AC) vs. Off-Board V2G (DC)

Electrically, V2G (and V2H) may come in two varieties: on-board V2G (AC) and off-board V2G (DC).[xi]

On-Board V2G (AC)

With on-board V2G, the EV exports AC power to the grid, through a home EV supply equipment. For light-duty vehicles, the connector is SAE J1772; SAE J3072 defines the communication requirements with the supply equipment. The supply equipment needs to be bidirectional and to support the appropriate protocol with the vehicle and compatible with the local grid connection standards.

An issue is that the standard Type 1 SAE J1772 plug used in North America is a single-phase plug and does not have a dedicated neutral wire for the split phase 120/240 V service used in homes. This means that the J1772 plug can be used for V2G (feeding back to the grid at 240 V) but can’t be used directly (without an adaptor or a transformer) for split phase 120/240 V V2H. This issue reduces the customer value of the system, as AC V2G can’t readily be used as a standby generator for the home.

Many EVs come with additional plugs, in addition to J1772, for 120/240 V V2L applications. Examples included the NEMA 5-15 120 V plug (common residential plug) and the twist-lock L14-30 split phase 120/240 V plug (often seen on portable generators). The Hyundai IONIQ 5[xii] and the GMC Hummer EV[xiii] are examples of vehicles with additional plugs.

As of this writing, commercially available EVs in North America do not support on-board V2G, but some have been modified to test the concept for pilot programs.[xiv] However, many automakers have announced vehicles with bidirectional chargers, and possibly AC V2G, although there are little publicly available specifications.

Off-Board V2G (DC)

With off-board V2G, the EV exports DC power to a bidirectional DC charger.

Bidirectional charging has been supported by the CHAdeMO DC fast-charging standard for quite some time, and the Nissan Leaf has offered the feature since 2013[xv]. Several light-duty DC V2G pilots therefore used these vehicles. However, with the new Nissan Ariya electric crossover using CCS instead of CHAdeMO, Nissan effectively made CHAdeMO a legacy standard in North America.[xvi]

CCS is an alternative for off-board V2G, but, unfortunately, CCS does not yet support bidirectional charging. CharIN[xvii], the global association dedicated to CCS, is developing the standards for V2G charging[xviii]. The upcoming ISO 15118-20 is expected for the fourth quarter of 2021 and will include bidirectional charging. This will mark the official start of interoperability testing. However, it will take time to reach mass-market adoption since the new standard needs to be implemented and tested beforehand to overcome potential malfunctions on software and hardware side.[xix] BMW, Ford, Honda, and Volkswagen have all announced plans to incorporate bidirectional charging and energy management, with an implementation target of 2025, but it is not clear if this is for V2G AC or V2G DC.[xx]

A critique of off-board V2G is the high cost of bidirectional DC chargers.[xxi] A solution may be to combine the bidirectional charger with a solar inverter, integrating power electronics for residences with both solar panels and EV charging. The dcbel r16 is an example of such an integrated approach[xxii], combining a Level 2 EV charger, a DC bidirectional EV charger, MPPT solar inverters, a stationary battery charger/inverter and a home energy manager in a package that costs less than those components purchased individually.[xxiii]

[i] See https://greenmountainpower.com/rebates-programs/home-energy-storage/powerwall/ and https://greenmountainpower.com/wp-content/uploads/2020/11/Battery-Storage-Tariffs-Approval.pdf, accessed 20210526

[ii] See https://www.tesla.com/sites/default/files/pdfs/powerwall/Powerwall%202_AC_Datasheet_en_northamerica.pdf, accessed 20211008.

[iii] While medium and heavy vehicles like trucks and transit buses generally have little excess battery capacity, school buses during summer are an exception, as many remain parked during school holidays. See, for example, https://nuvve.com/buses/, accessed 20211208.

[iv] See https://www.electrive.com/2021/01/27/vw-calls-for-more-cooperation-for-v2g/, accessed 20211220.

[v] See https://www.etnews.com/20211101000220 (in Korean), accessed 20211210.

[vi] For example, Stellantis targets ~€20 billion in incremental annual revenues by 2030 driven by software-enabled vehicles. See https://www.stellantis.com/en/news/press-releases/2021/december/stellantis-targets-20-billion-in-incremental-annual-revenues-by-2030-driven-by-software-enabled-vehicles, accessed 20211207,

[vii] See https://www.mobilityhouse.com/int_en/magazine/press-releases/vda-v2g-vision.html, accessed 20211210.

[viii] See https://sunspec.org/2030-5-csip/, accessed 20211006.

[ix] See https://efiling.energy.ca.gov/getdocument.aspx?tn=236554, on page 9, accessed 20211208.

[x] “EV V2G-AC and V2G-DC, SAE – ISO – CHAdeMO Comparison for U.S.”, John Halliwell, EPRI, April 22, 2021.

[xi] See http://www.pr-electronics.nl/en/news/88/on-board-v2g-versus-off-board-v2g-ac-versus-dc/, accessed 20211008, for an in-depth discussion of on-board and off-board V2G.

[xii] See https://www.hyundai.com/worldwide/en/eco/ioniq5/highlights, accessed 20211006.

[xiii] See https://media.gmc.com/media/us/en/gmc/home.detail.html/content/Pages/news/us/en/2021/apr/0405-hummer.html, accessed 20211008.

[xiv] See https://www.energy.ca.gov/sites/default/files/2021-06/CEC-500-2019-027.pdf, accessed 202112108.

[xv] See https://www.motortrend.com/news/gmc-hummer-ev-pickup-truck-suv-bi-directional-charger/, accessed 20211008.

[xvi] See https://www.greencarreports.com/news/1128891_nissan-s-move-to-ccs-fast-charging-makes-chademo-a-legacy-standard, accessed 20211008.

[xvii] See https://www.charin.global, accessed 20211008.

[xviii] See https://www.charin.global/news/vehicle-to-grid-v2g-charin-bundles-200-companies-that-make-the-energy-system-and-electric-cars-co2-friendlier-and-cheaper/, accessed 20211008.

[xix] Email received from Ricardo Schumann, Coordination Office, Charging Interface Initiative (CharIN) e.V., 20211015

[xx] See https://www.motortrend.com/news/gmc-hummer-ev-pickup-truck-suv-bi-directional-charger/, accessed 20211008.

[xxi] See, for example, https://thedriven.io/2020/10/27/first-vehicle-to-grid-electric-car-charger-goes-on-sale-in-australia/, accessed 20211012.,

[xxii] See https://www.dcbel.energy/our-products/, accessed 20211012.

[xxiii] See https://comparesmarthomeenergy.com, accessed 20211210.