When adopting electric vehicles (EV), consumers are now favoring long-range light-duty EVs[1], with nearly all the growth coming from sales of long-range battery electric vehicles rather than short-range EVs or plug-in electric hybrids.[2] Given this development, I focus here on the unique characteristics of long-range light-duty EVs charging. Long-range EVs have three characteristics that differentiate them from other residential electrical loads:

- EVs are large and mobile loads—they are not always connected to the grid, and not every day.

- EV charging is highly price elastic—drivers seek the cheapest electrons.

- Drivers easily control when to charge—charging is flexible with the large batteries and the telematics of modern long-range EVs.

These characteristics—and especially customer behavior—mean that utilities can’t consider EVs like any other loads. Utilities need a new thinking to plan for EV charging and to assess how to best manage it to benefit ratepayers. These characteristics also have impact on public and workplace charging sites, their operators, and the businesses nearby.

Let’s see how different EV charging really is.

EVs Are Large and Mobile Loads

Most electrical loads are fixed, like water heaters and clothes driers. Mobile loads, like cell phones, are small. But EVs are unique because they are mobile and large electrical loads. They are indeed large—typically, 4 to 8 kW for a level 2 charger, and often 100 kW or more with a public direct current fast charger (DCFC). And they are mobile: we drive our cars around (obviously) and do not always keep them plugged in when parked. In fact, parked long-range EVs are more often unplugged than plugged.

Compare this to traditional household electrical loads of a comparable magnitude, which are wired in, like water heaters, or permanently plugged, like clothes driers. Industrial loads in the 100-kW range are usually fixed and wired in.

So What?

This means that the EV charging load is less predictable than traditional electrical loads, both in space and time. An EV driver may charge at home with a level 2 charger, on the way to the cottage with a public DCFC, and on a 120-volt wall plug (level 1 charging) once they get there. Over time and with large numbers of EVs on the road, we may learn where and when EVs are being charged, on average, bringing greater predictability to this load. But, until then, we will have to go with some uncertainty. However, understanding what drive EV customer behavior and what drivers can control helps reduce uncertainty.

EV Charging Is Highly Price Elastic

EV charging is highly price elastic—an economic term meaning that consumers are sensitive to charging price and adjust accordingly. If charging prices at a given time or location rises, the demand for charging then and there should fall. Conversely, lower prices spur usage.

Many studies confirm the high price elasticity of EV charging:

- Comparing the charging load profile in the Canadian provinces of Ontario (with time-of use electricity pricing) and Québec (without time-of-use) shows that time-of-use pricing is delaying peak charging by almost 2 hours, with a steep increase once off-peak pricing happens.[3]

- PG&E customers who have enrolled in EV-only rates conduct 93% of EV charging off peak; on Southern California Edison’s EV-only rate, 88% of charging is off-peak.[4]

- A small rate differential may induce a strong tendency for overnight charging. A study assessed the impact of the peak-to-super-off-peak price ratio going from small (2:1) to large (6:1). However, the share of super off-peak charging varied little, from 78% to 85% of EV charging taking place during super off-peak period (typically after 10 PM or midnight).[5]

- EV customers exhibit learning behavior, increasing their share of super off-peak charging and decreased their share of on-peak over time.[6]

- When free workplace charging is offered, it is used 3 times as much as when employees must pay for it.[7]

Drivers of gasoline or diesel cars are highly responsive to local petrol prices, shopping around or timing purchases when they can, as well as seeking coupons for cheaper gas.[8] When it comes to price, EV drivers seem to act like drivers of internal combustion vehicles.

So What?

The high price elasticity of EV charging is a strong indication that pricing and monetary incentives may be used to shape the EV charging load curve—at home, at work or in public.

This is not ignored by utilities, as “60 percent of utilities consider activities that would enable them to develop effective rate structures—such as studying EV charging ownership, behavior and rate impacts—to be the most important activity in preparing for increased EV adoption”.[9] For residential charging, driver sensibility toward prices opens the door for gamification programs and is also the main value drivers being considered for vehicle-to-grid pilots. Regarding public charging, Tesla is quietly testing out ways to incentivize its customers to charge their cars when electricity demand isn’t so high or when sites are not congested[10]—I would expect that other charging operators and utilities will also assess time-varying or dynamic pricing for public charging.

Drivers Easily Control When to Charge

Many forms of residential loads, such as air conditioning used when it is hot and ovens at dinner time, are predictable because consumers want or need to turn them on during specific situations or at regular times. EV charging is less predictable because drivers of long-range EVs have much more control on when (and therefore where) to charge. Drivers elect to use various charging patterns, depending on their needs:

- Residential EV charging load is well suited to respond to price signals. Modern light-duty EVs be easily programmed to begin charging at a preset time using dashboard menus or a cellphone app. If a smart home charger is installed, it too can limit charging to specific times. Drivers can also start and stop charging remotely with a car or a home charger apps.

- EV drivers pair charging with other activities, such as spending time in stores while waiting for their vehicles to charge.[11]

- A Reddit user posted a message received from Tesla, encouraging them to stop at select California Superchargers before 9 a.m. and after 9 p.m. over a weekend, for a lower charging price.[12]

- Drivers using an “empty battery” pattern tend to run the battery down to a very low state of charge (SOC) before recharging, like people fueling gasoline cars stopping at a gas station perhaps once a week.[13] In fact, not charging every day is recommended by automakers.[14]

- Another common pattern is “scheduled charging”, where drivers charge the battery at periodic intervals, even every day, regardless of the state of charge of the vehicle’s batterie.

- For many drivers, charging once or twice a week when the battery gets low is convenient. Others charge their EV at every opportunity[15], plugging into a charger if it’s available nearby, taking advantage of the fact that they do not need to remain beside the vehicle while it is charging.

In other words, drivers of long-range EVs are flexible and control when and where to charge so that it is best for them, either because it is convenient or less expensive.

So What?

Utilities, charging operators and business owners can leverage this flexibility, knowing the mobility and the price sensibility of EV drivers. Through price signals or promotions, they can nudge drivers to charge where and when it best suits them—to minimize stress on the grid, to balance usage of high-traffic charging sites, or to increase in-store retail sales.

Looking Forward

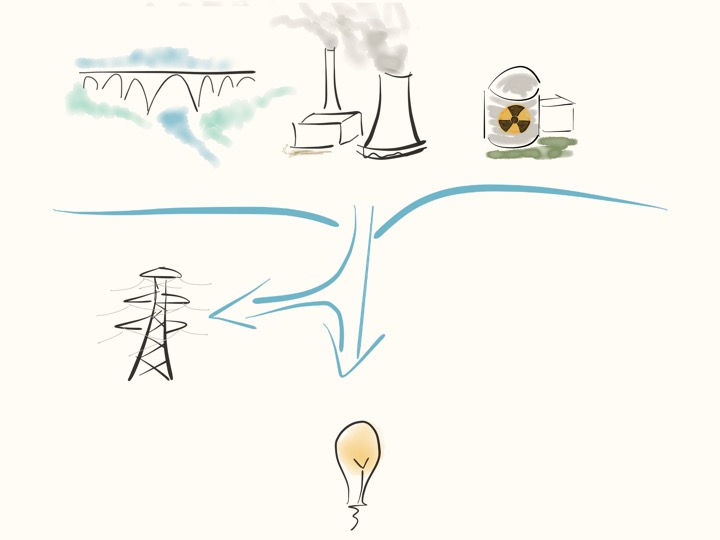

With steep forecasts of the number of light-duty EVs in some areas, many electric utilities are rightly concerned by the impact EV charging may have on their resource plans, both in terms of energy and capacity. Many see managed—or “smart”—charging as a solution to this disruption. Managed charging aims to shift EV charging to times when capacity is available in generation and in the grid. To effect managed charging, utilities may rely on metered rates, unmetered incentives, load control, or, very often, a combination of those approaches. Rates and incentives are behavioral approaches, attempting to nudge customer conduct, while load control works with the loads themselves.

However, utilities are not the only ones trying to influence the charging patterns EV drivers. There are indeed many stakeholders in the EV charging ecosystem: utilities, cities, charging operators, local businesses, real-estate developers, state/provincial governments, federal government, regulators, automakers, charger manufacturers, etc. For example, installation of chargers at commercial sites and their charging rates is primarily driven by business considerations, such as attracting customers (a business owner objective), and not to benefit the grid (a utility objective) or to ensure sufficient coverage or capacity for EV drivers (which are government objectives). Another example: utilities and their regulators may set rates for public charging stations, but charging operators control end-user pricing and service conditions.

Greater collaboration and alignment among these stakeholders, with better understanding of driver behavior, will be essential for the EV charging infrastructure to develop harmoniously.

[1] Long-range electric vehicles (EV) typically have an EPA-rated range of around 250 miles (400 km) or more, with batteries of at least 60 kWh. Examples in 2021 include the Tesla Model 3 and the Kia Niro EV. Shorter range EVs also exist, like some Nissan Leafs, along with plug-in hybrids vehicles, like the Toyota RAV4 Prime.

[2] Long-Term Electric Vehicle Outlook 2020, BloombergNEF, May 19, 2020, page 65.

[3] Charge the North project, Presentation to the Infrastructure and Grid Readiness Working Group by Matt Stevens, FleetCarma, September 2019, page 14.

[4] Beneficial Electrification of Transportation, The Regulatory Assistance Project (RAP), January 2019, p. 66.

[5] Final Evaluation for San Diego Gas & Electric’s Plug?in Electric Vehicle TOU Pricing and Technology Study, Nexant, Inc., February 20, 2014.

[6] Final Evaluation for San Diego Gas & Electric’s Plug?in Electric Vehicle TOU Pricing and Technology Study, Nexant, 2014, p.44.

[7] Employees with free workplace charging get 22% of their charging energy from work, while employees with paid workplace charging get 7% of their charging energy from work. Charge the North project, Presentation to the Infrastructure and Grid Readiness Working Group by Matt Stevens, FleetCarma, September 2019, page 13.

[8] See https://voxeu.org/article/gasoline-demand-more-price-responsive-you-might-have-thought, accessed 20191107.

[9] Black & Veatch 2018 Strategic Directions: Smart Cities & Utilities Report, Black & Veatch, 2018, pages 10.

[10] See https://insideevs.com/features/454482/getting-best-deal-tesla-superchargers, accessed 20210416.

[11] See https://atlaspolicy.com/wp-content/uploads/2020/04/Public-EV-Charging-Business-Models-for-Retail-Site-Hosts.pdf. accessed 20210416.

[12] See https://www.reddit.com/r/teslamotors/comments/jkhdx8/supercharging_discount_this_weekend_in_california/, accessed 20210416.

[13] The Life of the EV: Some Car Stories, Laura McCarty and , Brian Grunkemeyer, FlexCharging, presented at the 33rd Electric Vehicle Symposium (EVS33), Portland , Oregon June 14-17, 2020, page 6.

[14] See, for instance, the recommendations of Hyundai at https://www.greencarreports.com/news/1127732_hyundai-has-5-reminders-for-making-your-ev-battery-last-longer.

[15] Charging frequency of private owned e-cars in Germany 2019, Published by Evgenia Koptyug, Oct 21, 2020, https://www.statista.com/statistics/1180985/electric-cars-charging-frequency-germany/, accessed 20210305.