We often speak of peak oil as a global summit. But global averages obscure the essential point: the energy transition is asymmetrical and asynchronous.

(LinkedIn: https://www.linkedin.com/pulse/what-peak-fossil-looked-like-analog-benoit-marcoux-gx0se/)

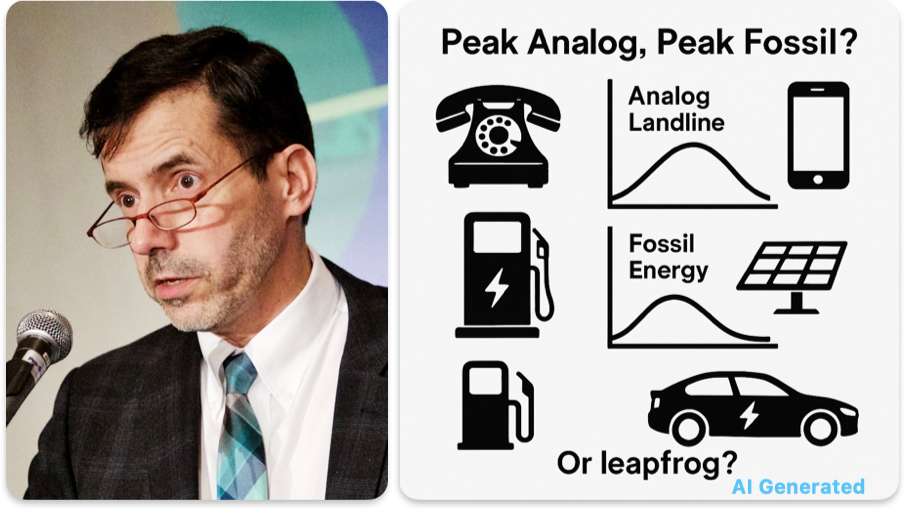

In some countries, fossil fuel consumption has been declining for years. In others, it continues to rise. And in many developing countries — like Ethiopia, Rwanda, or Bangladesh — it never really took off. These countries could leap directly to clean technologies, just as many skipped landline telephony and went straight to mobile.

This is precisely what happened with analog phones. It took a century to build that system… and less than a generation to dismantle it once more agile digital alternatives appeared.

The question isn’t when the world will reach peak fossil. The real question is: who will choose to never enter that system at all?

What if peak fossil looked like peak analog?

In North America, analog telephony peaked around the year 2000. Then came the digital wave: mobile, VoIP, fibre. Traditional landlines declined. That moment is now known as peak analog.

But this peak wasn’t global. In Europe, it came a bit later. In China, around the mid-2000s. And in many developing countries, it never came at all. These countries skipped copper lines and went straight to wireless.

A similar pattern is emerging in energy.

Peak fossil: a staggered transition

In some countries, fossil fuel use has already peaked:

- In Europe, coal and oil have been declining for years.

- In the United States, coal peaked in 2007.

- Even in China, several industrial provinces have plateaued in per capita coal use.

But energy demand is still growing. This skews the global picture. If we only look at the world average, the transition seems slow, or nonexistent.

The illusion of aggregates

That’s where the analogy with telephony becomes useful.

Aggregates obscure local dynamics. Yet it’s the early movers — the leading edge of the S-curve — that show the direction of travel. The energy transition, like the digital revolution, isn’t happening at the same pace everywhere. It progresses in fragmented ways, more like a series of small cascades than a single Niagara-style drop: local steps that, once triggered, transform the entire energy landscape.

The lesson of analog phones: slow rise, rapid fall

Analog telephony took decades to build. In Canada, it took nearly a century to reach universal service. However, by the 1990s, new technologies, such as mobile, fibre, and the internet, gained traction due to telecom deregulation, initially complementing rather than replacing existing analog infrastructure.

Analog landlines peaked around 2000. Within 20 years, much of the infrastructure was being dismantled. By 2020, many telecom operators had started retiring copper-based Public Switched Telephone Network (PSTN) services and switching to VoIP and mobile. The UK, Germany, the Netherlands, and Australia had announced full phase-outs between 2020 and 2025, some halting new PSTN connections by 2023.

This shows how an industrial system can take decades to establish — and only a few years to unwind once a viable alternative is in place and supported by policy.

In many African and Asian countries, waitlists for landlines stretched over years or even decades. Ultimately, those lines were never installed: people went straight to mobile phones, which were cheaper and faster to deploy. It’s a striking example of infrastructure made obsolete before it was ever built.

A similar dynamic is unfolding in energy. In many developing countries, fuel distribution is controlled by inefficient state monopolies, vulnerable to global shocks. Fuel is often subsidized, putting strain on public finances and complicating energy transition efforts. Electricity, too, is frequently managed by underperforming public utilities rooted in centralized logic. Like landline monopolies, these structures can block access, raise costs, and discourage investment.

The result? Citizens and entrepreneurs are turning to alternatives: rooftop solar, batteries, electric vehicles. Once again, legacy infrastructure is being bypassed rather than reformed.

Examples of energy leapfrogging

Three emblematic cases show how some countries are not replacing fossil systems — they’re bypassing them entirely:

Ethiopia — In 2024, Ethiopia banned the import of gasoline and diesel vehicles. The aim: reduce dependence on fossil fuel imports. Despite limited charging infrastructure, the country took a bold leap, raising major logistical and technical challenges.

Pakistan — Fossil fuels are heavily subsidized, sometimes up to 10% of the national budget, burdening public finances. Local solutions are emerging: rooftop solar, microgrids, electric vehicles. By 2025, solar generated over 25% of electricity, more than twice that of the previous year, due to affordable imported panels.

Hungary — Since 2020, Hungary has seen a solar boom. Installed capacity rose to over 5 GW, much of it decentralized. This rapid shift, enabled by subsidies, simplified permitting, and the European energy crisis, shows how smaller countries can pivot quickly when the conditions align.

Other cases — Many countries exhibit similar patterns at smaller scales:

- Rwanda — Aims to fully electrify motorcycle taxis using battery swap systems.

- Bangladesh — Over six million households use solar home systems; fossil-based centralized power was never widespread in rural areas.

- India — Off-grid villages rely on solar microgrids, making clean power their first electricity experience.

- Kenya — Pay-as-you-go financing (e.g., M-KOPA via M-Pesa) enables access to solar power without upfront infrastructure.

- Indonesia — Jakarta pilots the conversion of gasoline scooters to electric ones to avoid fossil lock-in.

- Norway — A mature case: over 90% of new car sales are electric, proving that a rapid fossil exit is possible when policy and markets align.

What these examples reveal

Peak fossil is not a single global moment, but a series of local turning points.

Some countries will never experience it — because they never entered the fossil era in earnest.

As with telecom, the fastest transitions don’t always come from the richest markets. Agility and opportunity matter more than legacy.

The story isn’t just about phasing out fossil fuels. It’s about choosing to never phase in.

A scattered but irreversible transition

Waiting for global aggregates to validate the transition risks missing the signal. It’s in local dynamics, investment choices, and institutional shifts that change is happening.

The story of peak analog teaches us this: technology can fade quietly, without drama, because something more accessible, flexible, and effective took its place.

The energy transition, like past industrial shifts, won’t be symmetrical. It will be uneven, fragmented — and ultimately decisive.