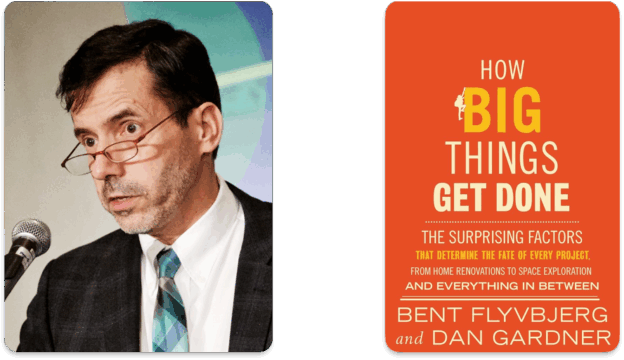

I recently read How Big Things Get Done by Prof. Bent Flyvbjerg and Dan Gardner . It’s a fascinating book, both scholarly and accessible, that dives into the world of large infrastructure projects. The authors analyze a database of more than 16,000 projects and demonstrate, with data, that most exceed their budgets and schedules, sometimes dramatically.

(LinkedIn Version: https://www.linkedin.com/pulse/how-big-things-get-done-fail-benoit-marcoux-ti0re/)

I have never directed a megaproject on the scale described in the book. I led a team on a project worth over $100 million. While this was a significant endeavour, it paled in comparison to the billions invested in projects such as dams, nuclear power plants, or the Olympic Games, as analyzed by Flyvbjerg. Still, I was curious to see what I could take away, and I found lessons that apply even at smaller scales.

The point is not that everything is doomed to fail, but that some types of projects succeed much more often than others. The key messages are clear: modularity is powerful and think slow, act fast. When a project can be broken into repetitive, standardized modules—as is the case for solar or batteries—risks drop sharply. In contrast, unique, massive, and highly innovative undertakings, like hydroelectric dams or nuclear plants, accumulate risks of cost and schedule overruns. Flyvbjerg notes that a percentage of these are “fat tail” projects, where risk distributions are skewed: the right side of the curve is much heavier than in a normal distribution, making extreme cost or time overruns far more likely.

Intrigued, I wanted to see how Hydro Québec fits into this picture. My intuition was that the company performs better than the global average, because it has built dams in series for decades, accumulating rare institutional expertise. An analysis of new plants commissioned in the past 25 years confirms this intuition: while the global average overrun for dams is about +75% in Flyvbjerg’s database, Hydro-Québec’s record appears much more moderate.

Sainte-Marguerite-3, commissioned in 2003, with its risky innovations (large turbine-generator units assembled on site, underground construction), faced serious technical difficulties and was one of the toughest projects of the past few decades. Public sources indicate a construction cost of about $2.5 billion, not far above the original estimate, since many deficiencies were under warranty. But commissioning was delayed by two years, and extended problems meant that full capacity was only reached in 2007, followed by another breakdown in 2009. These delays created an opportunity cost, since the expected electricity could not be delivered. Depending on assumptions about lost output and electricity prices, this opportunity cost could amount to several hundred million dollars—a hidden overrun not reflected in construction accounts, but still limited to about 20 to 25% of construction costs, well below the average overruns measured by Flyvbjerg.

For plants like Eastmain-1A and Sarcelle (commissioned between 2011 and 2013) and Romaine-1 to -3 (commissioned between 2014 and 2017), cost information is less precise, but no major overruns have been reported.

Romaine-4, commissioned in 2022, was more difficult, with technical challenges (such as friable rock) and the COVID-19 pandemic. The total cost of the Romaine complex reached $7.4 billion, only 14% above the initial estimate. Romaine-4 was the main cause of that overrun.

Overall, Hydro-Québec’s performance is far better than the global average for hydro projects in Flyvbjerg’s database, even when including challenging projects such as Sainte-Marguerite-3 and Romaine-4.

This Québec exception is likely explained by the “series effect”: seven generating stations were commissioned in the last 25 years. When engineers move from one site to the next, organizational memory offsets part of the risk. The series effect also extends to the supply chain, strong in Québec, with turbine manufacturers (Voith Hydro, ANDRITZ Hydro, GE Vernova, Litostroj Hydro) and major contractors (such as Pomerleau ), supported by a complete ecosystem of international manufacturers (such as Hitachi Energy and Schneider Electric) and numerous local SMEs. This ecosystem, still too little known to the public, is one of Québec’s industrial jewels and a key factor in Hydro-Québec’s success. Still, the risk of overruns remains real, and Hydro-Québec’s projects are not immune. This risk may even grow as the pace of new construction slows, although part of the expertise will persist through refurbishment work already underway on existing plants.

Nevertheless, the contrast with solar projects is striking: Flyvbjerg’s database shows that they have almost no overruns. These technologies, naturally modular, quick to deploy, and predictable in cost, must be part of Québec’s toolbox. Developing local expertise in these fields is not a luxury; it is a necessity if we want to manage risks while meeting electrification needs.

How Big Things Get Done reads both as a warning and as a practical guide. Québec built its energy history on hydro megaprojects that set it apart in global statistics. For the future, it will likely need to combine that tradition with the modular spirit of solar and storage. Think slow, act fast—and choose the right tools for the big things to come.